Introduction:

In the complex world of insurance, finding a reliable partner is essential for safeguarding your assets and securing peace of mind. Liberty Mutual, a prominent insurance provider, has established itself as a trusted name in the industry. This review article delves into the key features, coverage options, and customer care provided by Liberty Mutual.

Diverse Coverage Options:

Liberty Mutual offers a broad spectrum of insurance products to cater to various needs. From auto and home insurance to life, renters, and business insurance, the company provides a comprehensive range of coverage options. This diversity allows customers to consolidate their insurance needs under one provider, streamlining the overall management of policies.

Customizable Policies:

One of Liberty Mutual’s strengths lies in its commitment to providing customizable insurance solutions. The company understands that one size does not fit all, and as such, it offers the flexibility to tailor policies to meet the unique requirements of individual customers. This personalized approach enables clients to choose coverage that aligns with their specific circumstances.

Auto Insurance Excellence:

Liberty Mutual is particularly well-regarded for its auto insurance offerings. The company provides standard coverage options such as liability, collision, and comprehensive, alongside additional features like new car replacement, better car replacement, and accident forgiveness. Liberty Mutual’s commitment to innovation in the auto insurance sector has made it a preferred choice for drivers seeking reliable coverage.

Home Insurance Protection:

For homeowners, Liberty Mutual’s home insurance policies offer protection against a range of risks, including fire, theft, and natural disasters. The company provides customizable coverage options, allowing homeowners to safeguard their property and possessions according to their needs. Liberty Mutual’s dedication to helping homeowners recover from unexpected events is reflected in its comprehensive home insurance solutions.

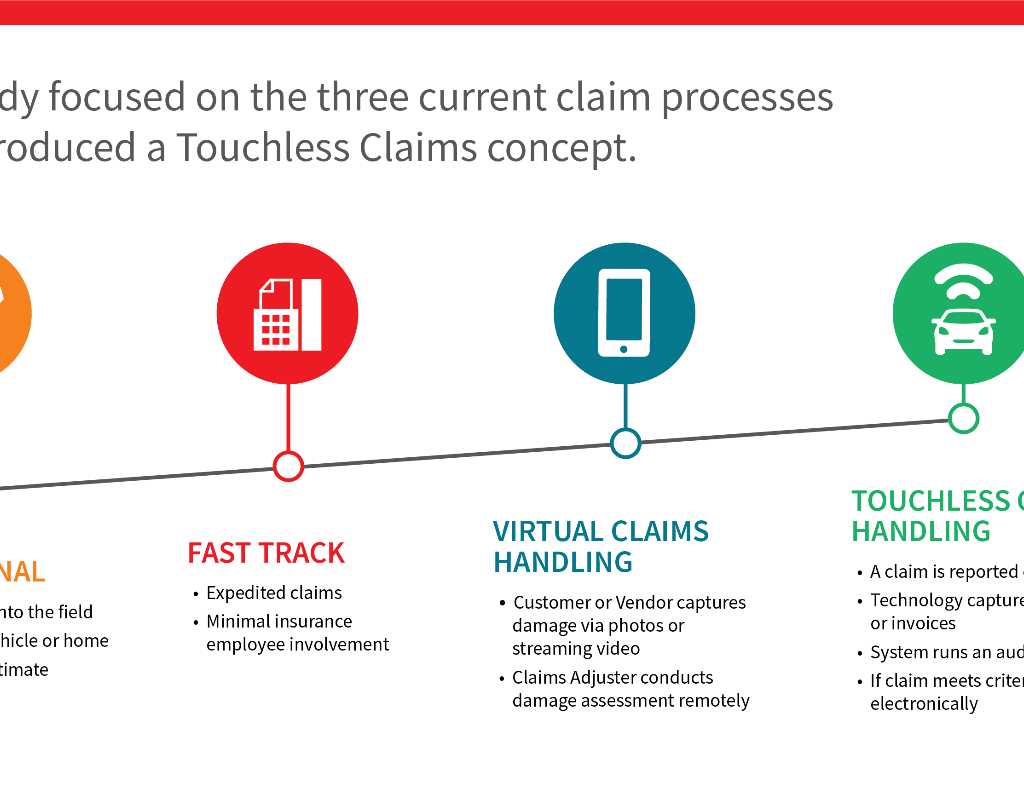

Customer-Focused Claims Process:

The claims process is a crucial aspect of any insurance provider’s service, and Liberty Mutual excels in this area. The company is known for its customer-focused claims handling, aiming to make the process as smooth and stress-free as possible. With a user-friendly online claims portal, prompt responses, and a dedicated claims team, Liberty Mutual prioritizes customer satisfaction during challenging times.

Discounts and Savings:

Liberty Mutual offers a variety of discounts and savings opportunities to its policyholders. These can include safe driver discounts, multi-policy discounts, and various other incentives to help customers save on their premiums. The company’s commitment to providing value for money is evident in its efforts to make insurance more affordable for its diverse customer base.

Financial Strength and Stability:

Liberty Mutual’s financial strength is a key factor in its reliability as an insurance provider. The company’s stability and solvency ensure that it can meet its financial obligations, providing policyholders with confidence in the long-term security of their coverage.

Customer Service and Accessibility:

Liberty Mutual places a strong emphasis on customer service, offering multiple channels for customer support, including phone, online chat, and a comprehensive online portal. The company’s commitment to accessibility and responsiveness contributes to a positive overall customer experience.

Conclusion:

Liberty Mutual stands out as a robust and customer-oriented insurance provider, offering a wide array of coverage options to meet diverse needs. With a commitment to customization, excellent customer service, and a strong financial foundation, Liberty Mutual continues to be a reliable choice for individuals and businesses seeking comprehensive and trustworthy insurance solutions.

Leave a Comment