In an era where financial literacy is paramount, tools that help individuals understand and manage their finances have become increasingly essential. Credit Karma, a popular financial management platform, has emerged as a go-to resource for millions seeking to navigate the complexities of their financial lives. In this comprehensive review, we’ll explore the various facets of Credit Karma, examining its features, benefits, and overall effectiveness in empowering users to take control of their financial well-being.

**3. Credit Reports and Monitoring

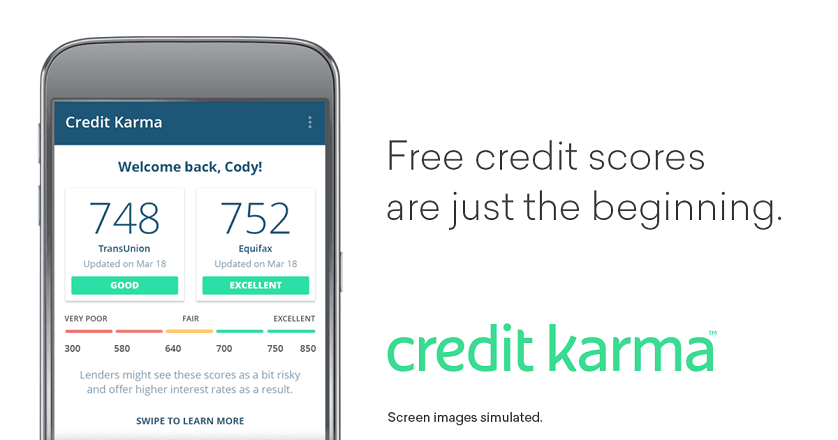

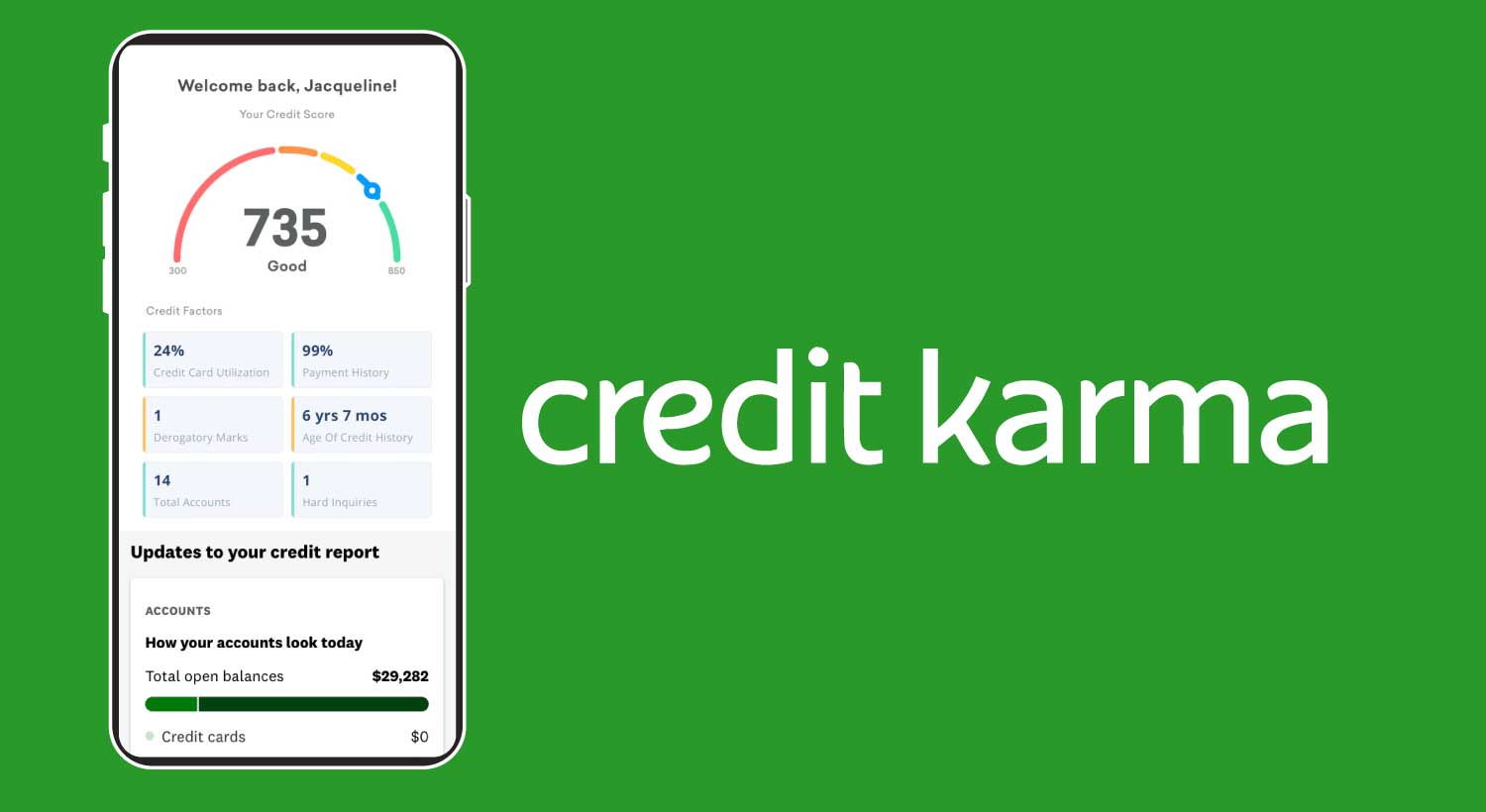

: Beyond credit scores, Credit Karma offers detailed credit reports, providing users with a holistic view of their credit history. The platform breaks down the factors influencing the credit score, allowing users to identify areas for improvement. The continuous credit monitoring ensures that users are promptly informed about any alterations to their credit profile.

**4. Financial Tools and Calculators:

Credit Karma goes beyond credit monitoring by offering a suite of financial tools and calculators. These tools help users simulate various financial scenarios, such as loan repayments, mortgage affordability, and credit card payoffs. The aim is to empower users with information to make informed decisions about their financial future.

**5. Credit Karma Tax

: For those navigating the complexities of tax season, Credit Karma Tax provides a free and user-friendly solution. The platform guides users through the tax filing process, ensuring accuracy and maximizing eligible deductions. This integration makes Credit Karma a one-stop-shop for both ongoing financial management and annual tax obligations.

**6. User-Friendly Interface:

Credit Karma’s user interface is intuitive and user-friendly, making it accessible to individuals with varying levels of financial literacy. Navigating through credit scores, reports, and financial tools is seamless, contributing to an overall positive user experience.

**7. Security and Privacy

: Given the sensitive nature of financial information, security is a top priority for Credit Karma. The platform employs industry-standard encryption and follows strict security protocols to safeguard user data. Additionally, it provides two-factor authentication for an added layer of protection.

**8. Conclusion:

In conclusion, Credit Karma stands out as a comprehensive and user-friendly platform for navigating personal finances. Its provision of free credit scores, detailed credit reports, financial tools, and tax filing capabilities makes it a valuable resource for individuals looking to understand, monitor, and improve their financial health. While there are alternative platforms in the market, Credit Karma’s commitment to accessibility and education positions it as a reliable ally for those on the journey to financial well-being.

Leave a Comment